Under the nonembedded deductible, all family members qualify for the plan benefit if the total annual family deductible amount is met by one or any combination of covered individuals If you have $2,000 in covered medical expenses for the year, and one child has $1,000, the annual family deductible is met for everyone covered under the policy, and all are eligible for the planThe organization type for You Collective Inc is Corporation and its contribution deductibility status is Contributions are deductible You Collective Inc is exempted by IRS under the category of Charitable Organization, Educational Organization, Religious Organization The organization is an independent organization or an independent auxiliaryA payment may be nondeductible even if it triggers Danish withholding tax which may be of relevance for interest and royalties Dividend withholding tax The withholding tax will be increased from 27% to 44% for certain dividends paid to shareholders in the designated noncooperative jurisdictions, see proposed section 2 of the Withholding Tax Act and section 2 of the Corporate

Onyx Fine Arts Collective Onyx Fine Arts Collective

What expenses are non deductible

What expenses are non deductible-Muchos ejemplos de oraciones traducidas contienen "nondeductible" – Diccionario españolinglés y buscador de traducciones en español27/5/ Aggregate deductibles are often used in family health insurance policies and under them An aggregate deductible means that the entire family deductible

When Activist Burnout Was A Problem 50 Years Ago This Group Found A Solution Waging Nonviolence

Plan Deductible Individual $500 Family $1,500 Individual $750 Family $2,250 Only the amount you pay for innetwork covered expenses counts towards your innetwork deductible Only the amount you pay for outofnetwork covered expenses counts towards both your innetwork and outofnetwork deductiblesThe Jonesy Collective is committed through the combination of individual contributions and public/private partnerships to create, produce and/or oversee communitybased events in which 100% of what the participant raises is returned to benefiting nonprofit organizations that share our mission and values Your taxdeductible contributionsAre only deductible to the extent that they exceed exempt income arising from the relevant participation in a given year Decreases in the acquisition cost of a participation that qualifies for the exemption are deductible The exempt amount of a capital gain realized on a qualifying participation is, however,

Spray See LA and MO is Supported by 1111 A Creative Collective, 501(c)3 non profit organization All contributions are tax deductibleCollective 2 forming a whole;17/3/15 A nonembedded, or aggregate, deductible is simpler than an embedded deductible With a nonembedded deductible, there is only a family deductible All family members' outofpocket expenses count toward the family deductible until it is met, and then they are all covered with the health plan's usual copays or coinsurance

It depends on the Fiscal Host of the Collective If the host has taxexempt status, then your donation can be tax deductible It also may matter which country the host is in The Open Source Collective 501(c)(6) is a nonprofit that serves as fiscal host to most open source software projects on Open CollectiveA deductible refers to the amount a policyholder is required to pay before an insurance provider assumes an expense The deductible is intended to prevent policyholders from making insurance claims that they can reasonably bear the cost for The deductible shares the risk between the policyholder and insurer Ultimately, insurance companies The first $1,500 will count against the embedded deductible However, the last $500 will be paid at the coinsurance level under the plan because A hit the embedded deductible By contrast, if A's plan did not have an embedded deductible, which is known as an aggregate deductible, all $2,000 would count against the $3,000 family deductible

Awards Ceremony Celebration Dinner The Intentional Living Collective

Onyx Fine Arts Collective Onyx Fine Arts Collective

Nonprofit we are currently working on obtaining our 501(c)(3) which allows our donors to claim a tax deductible donation!/3/18 Embedded Deductible — Each family member has an individual deductible in addition to the overall family deductible Meaning if an individual in the family reaches his or her deductible before the family deductible is reached, his or her services will be paid by the insurance company NonEmbedded Deductible — There is no individual deductibleCollective 365 is recognized as a public charity under Internal Revenue Code 170(b)(1)(A)(vi) and has 501(c)(3) status Donations to Collective 365 are deductible Donors should consult their tax advisor for questions regarding deductibility The Collective 365 EIN is

When Activist Burnout Was A Problem 50 Years Ago This Group Found A Solution Waging Nonviolence

Open Source Collective

With a nonembedded deductible, there is only a family deductible All family members' outofpocket expenses count toward the family deductible until it is met, and then they are all covered with the health plan's usual copays or coinsurance It doesn't matter if one person incurs all the expenses that meet the deductible or if two or more family members contribute toward meeting the family deductible The nonembedded deductibleDeductible A fixed dollar amount during the benefit period usually a year that an insured person pays before the insurer starts to make payments for covered medical services Plans may have both per individual and family deductibles ♦ Some plans may have separate deductibles for Understanding how health insurance works can be confusing, particularly when it comes to deductibles, a topic we've had a lot of questions about In today's post, Sandy Ahn discusses how an embedded deductible works in a health plan for family coverage and compares that to an aggregate deductible This information is also included in our online Navigator

Community Roots Midwife Collective

Non Deductible Traditional Ira Bogleheads

A nonprofit organization (NPO), also known as a nonbusiness entity, notforprofit organization, or nonprofit institution, is a legal entity organized and operated for a collective, public or social benefit, in contrast with an entity that operates as a business aiming to generate a profit for its owners A nonprofit is subject to the nondistribution constraint any revenues that exceedThis unique opportunity to give to Caroga Arts creates an extraordinary bond among our artists and communities Please let us know if you are interested in providing housing or meals for the artists Caroga Arts Collective is a taxdeductible 501 (c) (3) nonprofit organizationOnce you have joined Open Collective Foundation, you can immediately begin receiving taxdeductible donations and spending funds on your expenses You have a dashboard to manage your initiative, and our platform takes care of donation receipts, generates invoices, and takes care of

Individual Health Insurance Health Insurance Individual Vs Family Deductible

/GettyImages-959555912-5c0481ae46e0fb0001be9062.jpg)

How Embedded Deductibles Work

Allowing us to more effectively carry out our mission Announcements for official status will be posted soon!The KEY Collective envisions every child without the financial means having the same opportunities available to their peers, available to them, without any social stigma attached The KEY Collective is a registered nonprofit 501(c)3 organization All donations are tax deductibleSpotlight Arts Collective is a 501 (c)(3) nonprofit organization # Donations are tax deductible For more information on becoming a Friend of Spotlight, contact Rosemary Sexton at email protected or by calling SPOT

0cmrrz80xv4c5m

Gallery Asbx Shorts Episode 4 Artist Soapbox

Extended Play is a NonProfit for socially conscious film and media artists of Pennsylvania with a new focus on Women of Color In October of Ann Tegnell and Sharon Mullally decided to evolve their year nonprofit organization Extended Play Inc, and partner with SIFTMedia 215 and founders Lois Moses and Nadine Patterson AsUpstart crow collective is powered by Shunpike Shunpike is the 501 (c) (3) nonprofit agency that provides independent arts groups in Washington State with the services, resources, and opportunities they need to forge their own paths to sustainable successTax deductible status Contributions to Collectives hosted by the Open Source Collective are not tax deductible, as we are a 501(c)(6) nonprofit, not a charity 501(c)(3) If you are a USbased project with an explicitly charitable mission, and you wish to qualify for charity grants and tax deductible donations, you may wish you apply to Open Collective Foundation

Fundraiser Party Menageriedarte

Combined the collective assets of a corporation and its subsidiariesDONATE Collective Consciousness Theatre is 501c3 non profit organization All donations are 100% tax deductible Please consider giving by clicking here!R Creative Collective (RCC), is a Charlotte, NC based 501 (c)3 nonprofit Our mission is to use the transformative power of creativity to spread peace, give hope, support recovery, and connect communities Our vision is a resilient world where everyone, by being in touch with their most authentic self, can find purpose and connect with

Ndn Collective Announces Black Hills Bail And Legal Defense Fund Following Mt Rushmore Arrests Ndn Collective

Rfd Issue 21 Fall 1979 By Rfd Magazine Gay Issuu

The Neighborhood Women's Collective is a nonprofit organization under section 501(c)(3) of the United States Internal Revenue Code All donations to the Neighborhood Women's Collective, Inc are deductibleA deductible is the amount you pay each year for most eligible medical services or medications before your health plan begins to share in the cost of covered services For example, if you have a $2,000 yearly deductible, you'll need to pay the first $2,000 of your total eligible medical costs before your plan helps to payOpen Collective Foundation (OCF) is a fiscal sponsor and fiscal host (what's that?) dedicated to providing a simple, open, lightweight path for charitable initiatives and communities to operate through a 501(c)(3) charitable entity (what's that?Hosted initiatives that align with our impact areas have access to the unique Open Collective online platform for managing their funds

Hdhp Vs Ppo What S The Difference

Echo Theater Collective

The term embedded deductible means separate individual deductible In most PPO health plans you have, say a $1, deductible plan and it has a $ family deductible If a policy insures, say three people ( a father, mother and daughter) and two of them have medical procedures in the same year, then each must firstCore Collective is a Non Profit organization that focuses on a different cause each quarter that is submitted and voted upon by its members It's a one stop shop volunteer, seek education, and donate to several topics each year8/4/10 When given a choice, "embedded" deductibles provide better coverage for those covering dependents assuming all other benefits are the same Below is a list of California small group HSA compatible plans identifying whether they have embedded or aggregate deductibles I hope this helps!

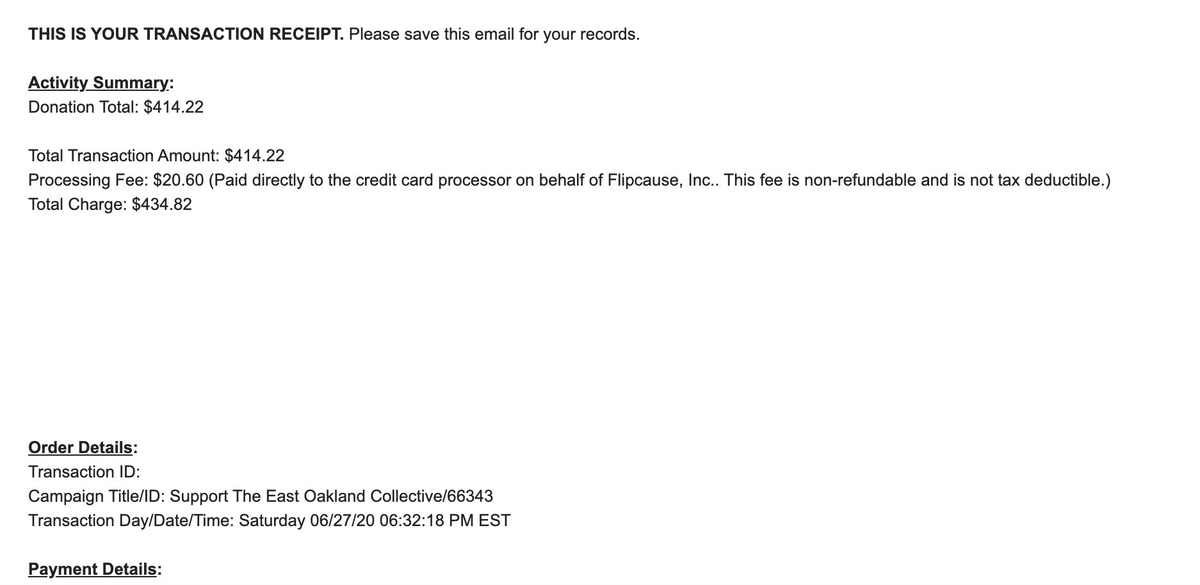

Erc 469 Update Thank You Didierh For Matching And Adding Some Extra Looking For 4 More Donations Of 414 22 To Match The Total Raised Last Night Who S Up People S Breakfast

Embedded Deductibles Source Of Consumer Confusion Center On Health Insurance Reforms

Should donations exceed the abovementioned 5 per cent, the remaining nondeductible amount shall not be usable for deduction throughout the following fiscal periods hospitalbritanicoorgar En el caso que las donaciones efectuadas superen el tope mencionado en el párrafo anterior, el excedente no computable no podrá deducirse en los próximos ejerciciosBlackSpace Urbanist Collective, Inc is a 501(c)3 nonprofit and all donations are tax deductible EIN 465Many translated example sentences containing "collective deductible" – FrenchEnglish dictionary and search engine for French translations

Rules For Deducting Qualified Pass Through Business Income

Holes In The Wall Collective A Creative Nonprofit

Welcome Atlanta Dance Collective is a nonprofit contemporary dance company based in Atlanta, Georgia We strive to connect the world through dance, pursuing creative distinction and social pertinence by creating vital new works, collaborating with new artists, and serving our community through our practice Want to make a taxdeductible gift to27/7/21 Say you backed your car into one of the light posts in the mall parking lot and caused $1,000 worth of damage to your car If your deductible is $1,500, the insurance will not pay to repair the damage If you had a $500 deductible, you'd pay $500, and they would pay $500The KEY Collective envisions every child without the financial means having the same opportunities available to their peers, available to them, without any social stigma attached The KEY Collective is a registered nonprofit 501(c)3 organization All donations are tax deductible

Cost Sharing Out Of Pocket Maximum Federal Rule Explained Regence

Incite National Org

Cree Collective Deductible Insurance Program 26 likes Insurance CompanyOpen Source Collective 501(c)(6) EIN 375 340 S LEMON AVE #3717, Walnut CA 917 USA email protected Contributions to Collectives hosted by OSC are not deductible as charitable contributions for US federal income tax purposesPhoenix Dance Cooperative is a structured, 501 (c) (3) nonprofit organization founded by parents We are very different from the other dance studios in Phoenix The driving force behind the organization is to provide highquality dance instruction with a focus on competition as a group while fostering a loving environment with a strong sense

True Family Embedded Deductibles Types Of Deductibles bs Wny

Financial Contributors Faq Open Collective Docs

Join Lux Lux Art Institute

Irs Provides Covid 19 Flexibility For Section 125 Cafeteria Plans And High Deductible Health Plans Baker Tilly

Support Scholarly Christian Education Westminster Academy

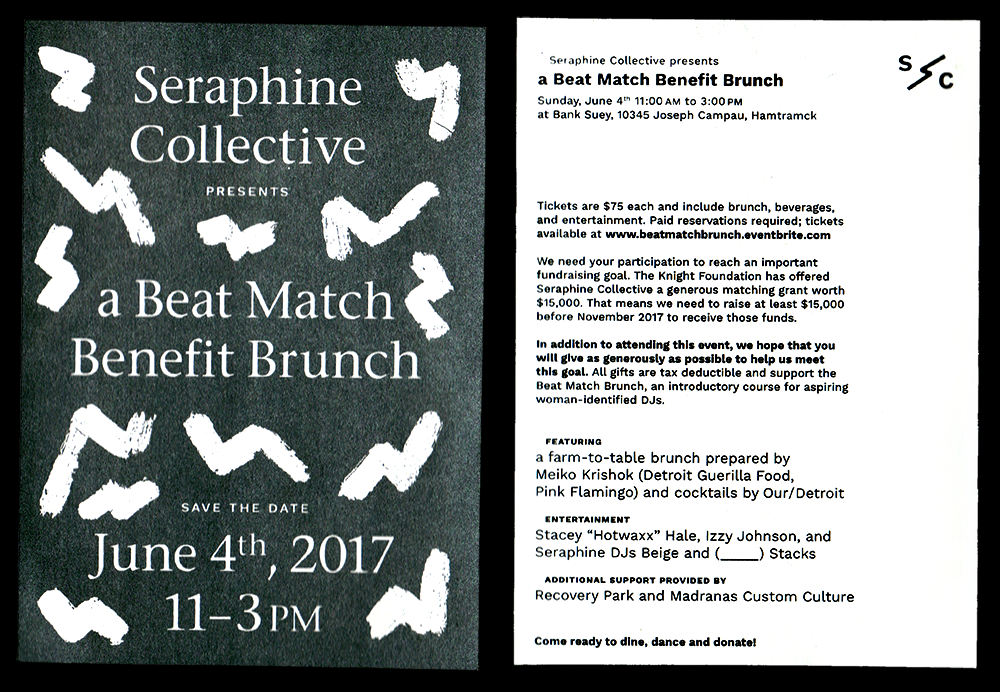

Seraphine Collective Nikki Roach

Community Roots Midwife Collective

Why Workplace Giving Matters America S Charities

Lysistrata

2

Affordable Counseling Affordable Therapy Open Path Collective

Divestfromdapl Action Disrupts Wells Fargo Branch Grand Opening Doors Secured With Bike Locks Unicorn Riot

1

The Master Policy Deductible V Personal Condominium Insurance Who Does What To Whom 15

No Exceptions Prison Collective Collaborating Toward Abolition And Liberation

Setting Up Github Sponsors Open Collective Foundation

The Master Policy Deductible V Personal Condominium Insurance Who Does What To Whom 15

How Does An Embedded Deductible Affect My Health Insurance Valuepenguin

Collectively Bargained Health Plans More Comprehensive Less Cost Sharing Than Employer Plans Health Affairs

2

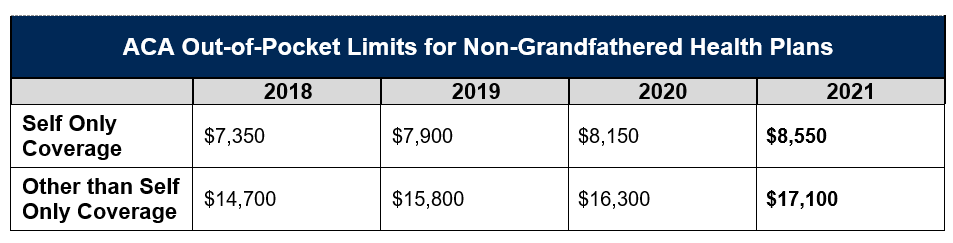

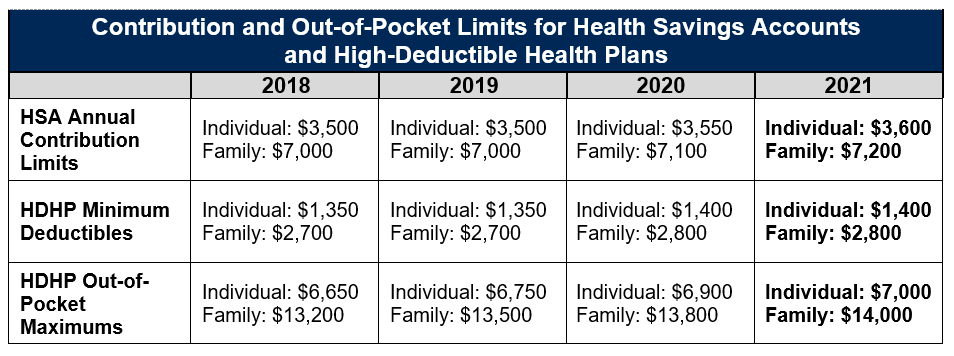

21 Out Of Pocket Limits Hdhp Minimum Deductibles And Hsa Contribution Limits Medcost

Open Source Collective

2

Screencapture Allianceforcommunityempowerment Org Contribute 18 03 11 23 04 03 Csun Impact Designhub

Different Types Of Deductibles Integra Insurance Services In Los Gatos California

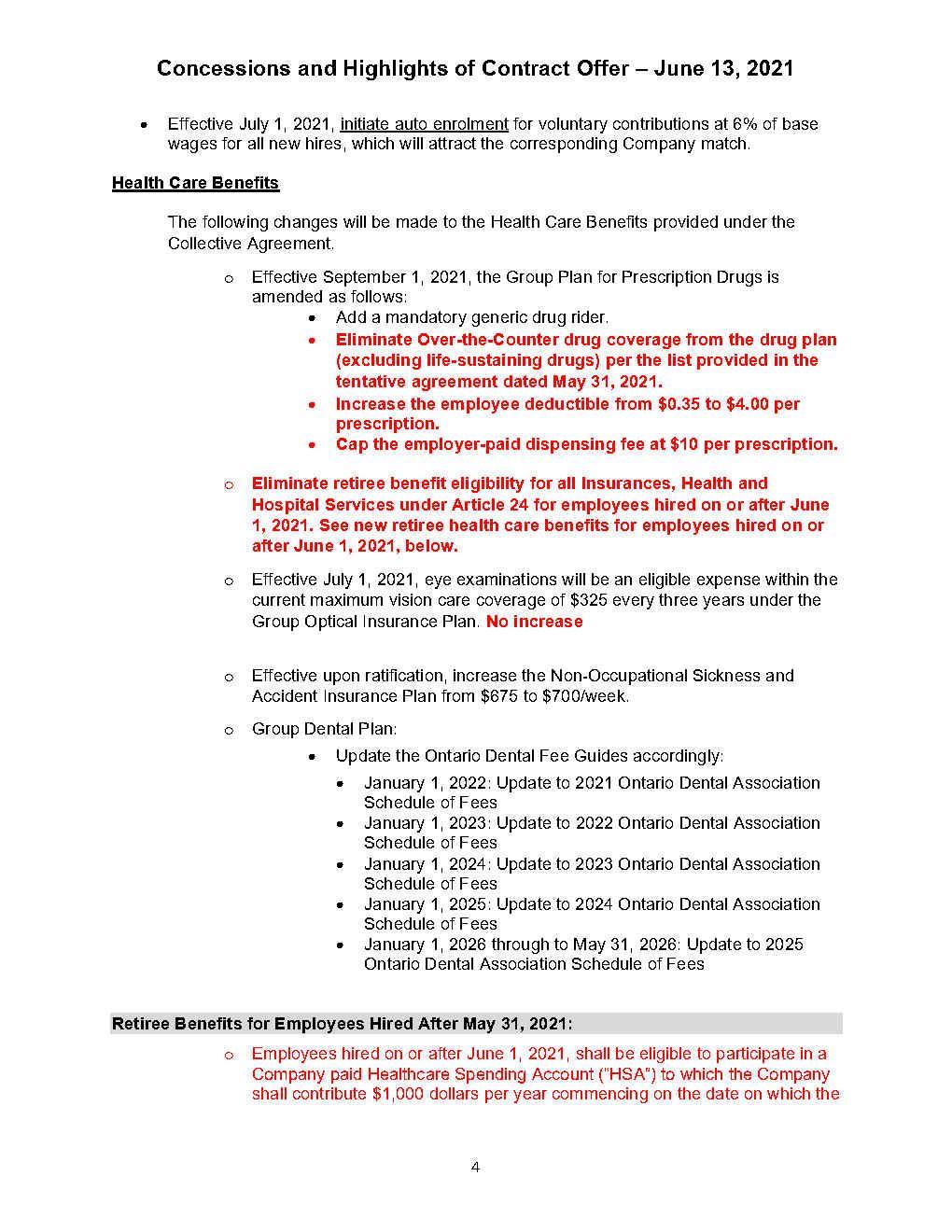

Concessions And Highlights Of Contract Offer June 13 21 Usw Local 6500

Retention And Transfer Structure With 3 Deductible Us 1 Million Download Scientific Diagram

1

1

2

Cut Fruit Collective

Fundraiser For The African American Center For Cultural Development Enchanted Mountains Of Cattaraugus County New York Naturally Yours

Bill Introduced To Make Charitable Donations Deductible For Everyone

Pdf Negotiating The Digital Transformation Of Work Non Standard Workers Voice Collective Rights And Mobilisation Practices In The Platform Economy

High Quality Benefits For Nonprofits Nonstop Wellness

Laszlo Bock I Ll Match Rklau S Match Of Donations To Flrightsrestore As Well Let S Make Sure Everyone Who Has The Right To Vote Is Able To Exercise That Right Tweet Rklau

Corporate Sponsorship Caroga Arts Collective

For Some Families Coverage With Separate Deductibles Might Be The Best Choice Kaiser Health News

Cob Collective Community Home Facebook

Grand Opening And Tentative Schedule Br A Ce Building Research Architecture Building Exchange

U1kuirubhm4ffm

2

2

Columbusrealtors Com

Ecc

The Pros And Cons Of High Deductible Health Plans Hdhps

Non Deductible Traditional Ira Bogleheads

Serb Ohio Gov

Financial Contributors Faq Open Collective Docs

I White Noise I Andrew Lampert

21 Out Of Pocket Limits Hdhp Minimum Deductibles And Hsa Contribution Limits Medcost

True Family Embedded Deductibles Types Of Deductibles bs Wny

Extras Mysite

Github Nonprofit Open Data Collective Publication 78 Data Download As A Zipped Text File The Most Recent List Of Organizations Eligible To Receive Tax Deductible Charitable Contributions Pub 78 Data

2

Together Rising

Renville County Historical Society And Museum

Donate Now

Rfd Issue 11 Spring 1977 By Rfd Magazine Gay Issuu

What Are Embedded And Non Embedded Deductibles

What S The Difference Between Family And Individual Deductibles

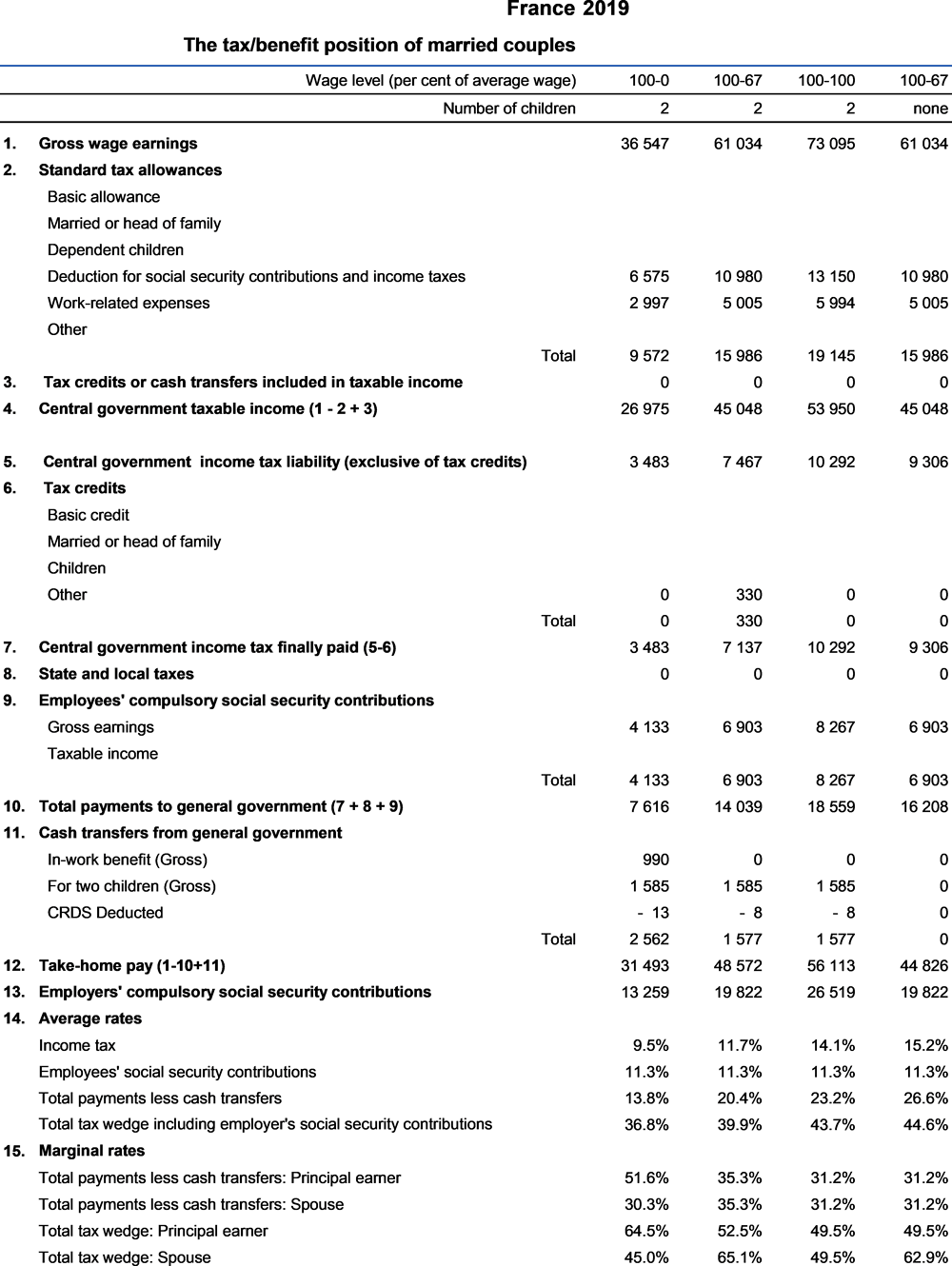

France Taxing Wages Oecd Ilibrary

Ufcwdrugtrust Org

Serb Ohio Gov

2

What Is The Difference Between An Embedded And Non Embedded Deductible Claimlinx

Upstart Crow Collective Home

Affordable Counseling Affordable Therapy Open Path Collective

The Role Of Collective Bargaining Systems For Labour Market Performance Negotiating Our Way Up Collective Bargaining In A Changing World Of Work Oecd Ilibrary

Onyx Fine Arts Collective Onyx Fine Arts Collective

.png?alt=media&token=d5274409-90cf-4a33-9b73-6bef974aef89)

Financial Contributors Faq Open Collective Docs

The Berry Collective Sylvia Berry

Donate

Fingerstyle Collective Guitar Festival Nonprofit Organization Festival Facebook

Iioa Org

Richmond Food Collective Shalom Farms Third Annual Fall Farm Dinner

Donate Patricia Rincon Dance Collective

/GettyImages-8442357801-3d494ac995834eeca0be3cebb8c2f197.jpg)

How Embedded Deductibles Work

Deductible

Donate Santa Fe Studio Tour

Memorandum To Uvm Non Union Faculty And Staff Members

0 件のコメント:

コメントを投稿